Bitcoin has faced a rather strong correction after its explosion to the $11,500 highs. At the recent lows, the asset traded as low as $10,600 — around 8% below the local highs.

Despite the retracement and the fact that BTC remains below $11,000, analysts remain bullish on Bitcoin. One historically accurate trader, for instance, just said that he thinks BTC could soon move higher to $12,000.

Related Reading: Crypto Tidbits: Ethereum Surges 20%, US Banks Can Hold Bitcoin, DeFi Still in Vogue

Analyst Expects $12,000 As Bitcoin Coils Above Crucial Support

Bitcoin may be failing to hold above $11,000 but the asset is still snug above the pivotal $10,500 horizontal.

According to a cryptocurrency trader, since BTC is holding above $10,500, it is preparing to undergo its next leg higher. Referencing the chart below, which was published on July 28th, the trader said:

“$btc consolidating above a pretty key breakout level. price contracting, volume declining, seems bullish, continuation soon.”

Chart of BTC's recent price action by trader SmartContracter (Twitter handle). Chart from TradingView.com

This is the same trader that predicted six months in advance that Bitcoin would bottom 2018’s bear market at $3,200. He made this prediction when the asset was trading around $7,000 — when few expected such a move to the $3,000s.

The aforementioned sentiment was echoed by a swath of other analysts, who argued that it would be unwise to “fade this rally.” As one trader noted, fading Bitcoin’s first break of macro resistance in a year after two days of rallying makes no sense.

Bitcoin’s bullish outlook has been corroborated by fundamental trends.

Mike Novogratz, the chief executive of Galaxy Digital and a former Goldman Sachs partner, made this comment on Tuesday:

“A lot of that retail interest shifted to the story stocks, to the tech stocks, because they were just more fun … Yesterday you saw a lot of money shift back over to gold and bitcoin. There’s an adoption game in bitcoin that you don’t have in gold. But I like them both.”

He said to CNBC that he expects money printing by central banks to push BTC to $20,000 by year end.

Not Everyone Is Convinced of Bull Case

Not everyone is convinced of the bull case, though.

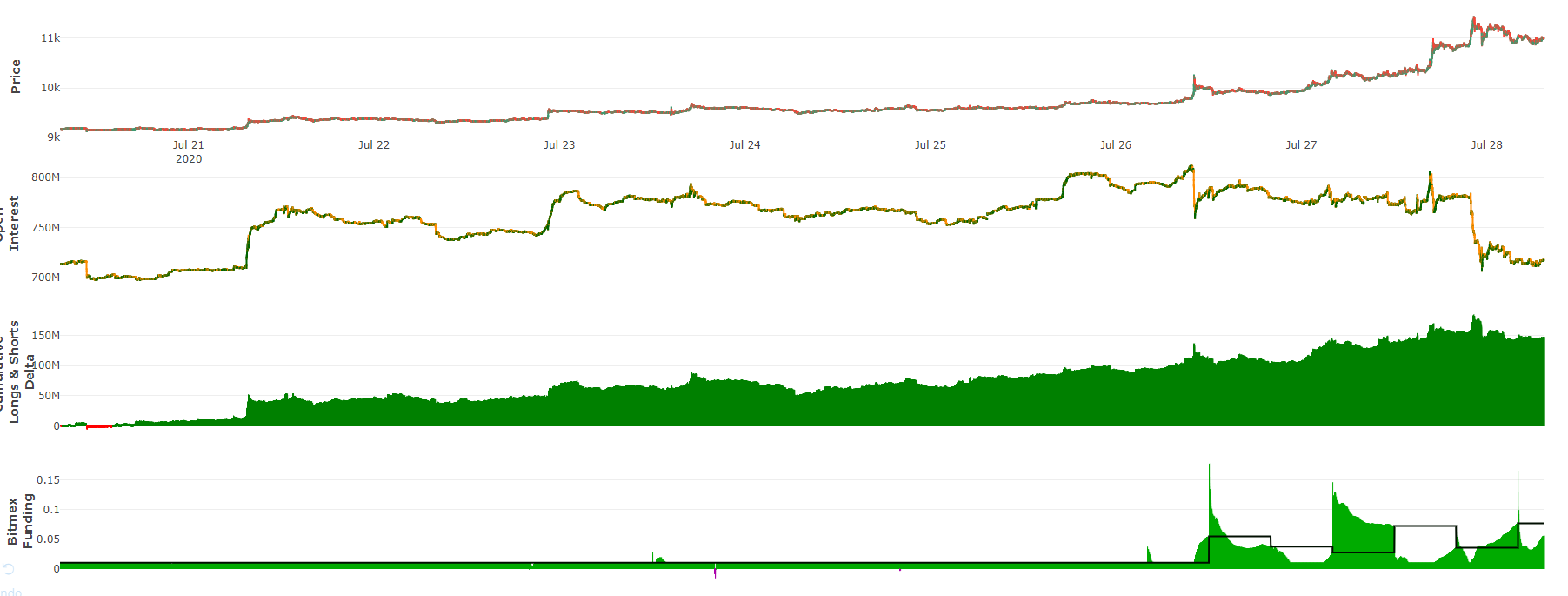

One prominent trader shared the image below after the surge to $11,500. It shows that the Bitcoin futures market may be overextended to the upside due to buyers taking on too much risk.

Namely, the funding rate is skewed heavily to the positive. High funding rates are often seen at market tops — or at least at points where BTC retraces during uptrends.

Chart from trader il Capo of Crypto (@CryptoCapo_ on Twitter)

Related Reading: On-Chain Metric Signals the BTC Market Isn’t Overheated: Why This Is Bullish

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Analyst Who Predicted BTC's 2018 Bottom Thinks $12k Is Imminent

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/07/analyst-who-predicted-bitcoins-2018-bottom-thinks-12k-is-imminent/

No comments:

Post a Comment