Huge value and excitement awaits in the GGPoker Spring Festival throughout April

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2021/03/get-ready-for-ggpokers-biggest-spring-series-ever/

Huge value and excitement awaits in the GGPoker Spring Festival throughout April

Credit: Source link

Decentralized finance has taken a back seat to nonfungible tokens over the past month but this hasn’t stopped the top DeFi projects from developing and strategizing how to grow their ecosystems and market share.

One project that has outperformed the field as of late is PancakeSwap (CAKE), the Binance Smart Chain-based automated market maker (AMM) that allows users to exchange tokens and earn a portion of fees through yield farming.

According to a recent report from Delphi Digital, several factors have played a significant role in helping the PancakeSwap ecosystem grow in recent months and analysts predict that the protocol will continue to be a serious competitor to Uniswap.

Anyone who has tried to transact on the Ethereum (ETH) network in 2021 will have noticed the astronomical rise in gas fees which has been compounded by the rising price of Ether.

If you compare this chart of the average gas fees on Etherum with the chart above detailing the monthly trading volume on PancakeSwap, a correlation can be seen between higher fees and more activity on the DeFi platform.

While Ethereum fees were ballooning, Binance Smart Chain (BSC) emerged as a viable option thanks to numerous cross-chain bridges and low transaction costs. PancakeSwap is the largest, most established DEX on the BSC thus it benefits from the influx of users and Binance’s large user base.

Delphi Digital analysts identified Binance’s immense ecosystem as another major factor providing a boost for CAKE as its “vast network effect” comes from being the “biggest crypto exchange that’s typically the first choice for retail traders.”

Prospective users can gain access to the BSC by simply withdrawing their tokens from Binance to a BSC-supported wallet.

Delphi Digital also highlighted CAKE’s token economics as a significant factor for its future growth.

Unlike UNI and SushiSwap (SUSHI), there is not a hard cap on the supply of CAKE tokens which gives the platform the “ability to perpetually conduct targeted vampire attacks in order to attract liquidity and incentivize projects to launch on PancakeSwap’s AMM.”

The current weekly inflation rate for CAKE is 3.78%, which is significantly higher than UNI’s 2% yearly inflation rate.

Even with various deflationary measures implemented by CAKE developers, the “net emission is approximately 1,000,000 CAKE per week – which translates to 37% real inflation annually (or 0.7% weekly).”

According to Delphi Digital, PancakeSwap is aware of how the current inflation numbers look and the team announced a governance vote to change the emission schedule with the options to leave it the same, decrease it to 23.5 or 22 CAKE per block.

The option to reduce emissions to 22 CAKE, a 20% decrease, is currently favored to win and this would reduce CAKE emissions by 1,050,000. This would help to neutralize inflation while also allowing the project to keep its vampire attack capabilities in the long-run.

Data from Cointelegraph Markets and TradingView shows that since reaching a low of $8.30 on Feb. 28, the price of CAKE has made several attempts to break out to a new all-time high and at the time of writing the altcoin trades for $15.63.

According to data from Cointelegraph Markets Pro, market conditions for CAKE have been favorable for some time.

The VORTECS score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity. A recent test of the system resulted in investment returns as high as 1,497% using specific strategies outlined in the report.

score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity. A recent test of the system resulted in investment returns as high as 1,497% using specific strategies outlined in the report.

Score (green) vs. CAKE price. Source: Cointelegraph Markets Pro

Score (green) vs. CAKE price. Source: Cointelegraph Markets ProAs seen in the chart above, the VORTECS Score for CAKE turned green and registered a 65 on March 21, roughly six hours before the price began to rally over the next four days.

Score for CAKE turned green and registered a 65 on March 21, roughly six hours before the price began to rally over the next four days.

After the initial precise rise on March 22, the VORTECS Score continued to climb and reached a high of 81 on March 25, three hours before the price began to rally 36%.

Score continued to climb and reached a high of 81 on March 25, three hours before the price began to rally 36%.

Strong backing from Binance and low fees on BSC have PancakeSwap in an enviable position to attract additional liquidity from the Ethereum-based DeFi protocols as a practical solution to high gas fees remains elusive. Despite inflation-related concerns, analysts have suggested keeping an eye on this Uniswap competitor as the battle for DeFi dominance continues to unfold.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Credit: Source link

The “Kimchi premium” is back. Bitcoin (BTC) is trading more than 6% higher across major South Korean crypto exchanges as of March 29.

Data from CryptoQuant shows that the premium in the South Korean market was nonexistent for many months and, in fact, dropped to around -6% in early February when BTC dipped below $30,000.

The so-called Kimchi premium forms when the price of Bitcoin trades higher on South Korean exchanges than other markets.

The return of this premium is a bullish sign suggesting that demand for Bitcoin in South Korea is likely outpacing supply.

Although South Korea does not account for a majority share of the global Bitcoin market, it remains one of the major exchange markets by daily volume.

On CoinMarketCap, as an example, Bithumb is listed as the seventh-largest exchange in the world by daily trading volume, registering $1.3 billion in Bitcoin traded over the past 24 hours.

The premium was especially high during past bull cycles, particularly in 2017 when BTC was trading well over 20% higher on South Korean exchanges compared with Coinbase and other large exchanges.

The Kimchi premium shows two major trends. First, it shows that the overall market sentiment in South Korea remains healthy. Second, it indicates that more buyers are entering the market.

Market sentiment in Korea is not bad. $BTC sellers are not Koreans obviously. https://t.co/4UIneKZKuu

— Ki Young Ju 주기영 (@ki_young_ju) March 25, 2021

The premium was already rebounding during the past several weeks before Visa announced that it will process transactions using USD Coin (USDC) on the Ethereum blockchain.

When the news was announced, both Bitcoin and Ether (ETH) rose by around 5% within three hours, leading to a strong recovery in the cryptocurrency market. The announcement may add more momentum to the rapid pace of institutional adoption so far this year and the possibility of a broader Bitcoin rally. “I smell crypto mass adoption here,”

According to the pseudonymous trader known as “Rekt Capital,” if Bitcoin breaks above $59,000, a new all-time high becomes highly probable.

The trader noted:

“BTC is recovering this week after the down-side wicks of the previous 2 weeks showed slowing in the sell-side momentum $BTC will attempt to crack the confluent black diagonal & red horizontal resistance area (~$59,000) Break this area and #Bitcoin will reach new All-Time Highs.”

Fellow trader “CryptoCapo,” meanwhile, said that this momentum can potentially take Bitcoin to new highs and above, possibly to even $80,000. He said:

“The panic didn’t make any sense. Some people just want to see the world burn… Send it to $80k+”

Credit: Source link

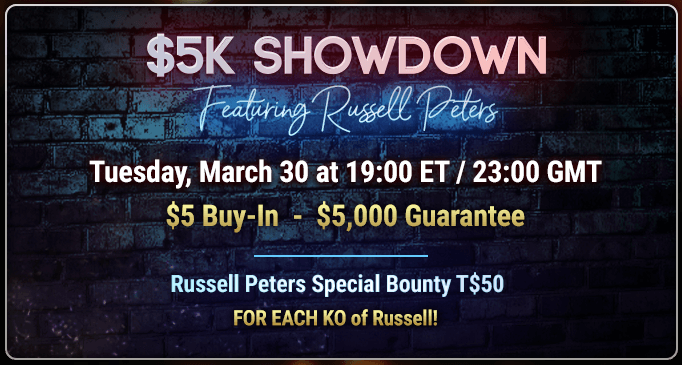

Are you ready to join stand-up comedian Russell Peters and battle against him in his own poker tournament? Well you can on GGPoker this week.

Peters has over four million Twitter followers and in 2013 was the first stand-up comedian to get a Netflix stand-up special.

With a guaranteed prize pool of $5,000 for just a $5 buy-in, this is one tournament you must not miss! Also up for grabs are special bounty prizes if you eliminate Peters.

Knock out Peters and a T$50 bounty prize will be credited straight to your account!

Related: Master These Three GGPoker Features to Improve Your Online Game

Start your GGPoker career with $600 welcome bonus. Download GGPoker via PokerNews to grab your lucrative 200 percent welcome bonus worth up to $600 on your first deposit.

The bonus releases into your account in $10 increments each time you earn 6,000 Fish Buffet Points, which is the equivalent of $60 in rake or tournament fees.

Good luck!

Dzivielevski Denies Addamo Fourth Super MILLION$ Title

Credit: Source link

The open interest on Bitcoin (BTC) Dec. 31 call options between $100,000 and $300,000 reached an impressive 6,700 contracts, which is currently worth $385 million. These derivatives give the buyer the right to acquire Bitcoin for a fixed price, while the seller is obliged to honor the price.

One might think that this is a great way to leverage a long position, but it comes at a cost and is usually quite high. For this right, the buyer pays an upfront fee (premium) to the call option seller. For example, the $100,000 call option is currently trading at 0.164 BTC, equivalent to $9,480.

For this reason, option traders seldomly buy these options by themselves. Therefore, longer-expiry derivatives usually involve multiple strike prices or calendar months.

Shown above is an actual trade arranged by Paradigm, an institutional investor-focused over-the-counter trading desk. In this trade, a total of 37 BTC December $100,000 and $140,000 calls have been traded between two of their clients.

Unfortunately, there’s no way to know which side the market maker was, but considering the risks involved, one can assume the client was looking for a bullish position.

By selling the $140,000 call option and simultaneously buying the more expensive $100,000 call, this client paid a $138,000 upfront premium. This amount represents their max loss, which takes place at $100,000 price on Dec. 31.

The red line on the above simulation shows the net outcome at expiry, measured in BTC. Meanwhile, the green line displays the theoretical net return on June 30.

Thus, this client needs Bitcoin to trade at $65,600 or higher on June 30 to recoup their investment. This number is significantly lower than the $107,150 required for the break-even if this “call spread” strategy buyer holds until the December expiry.

This phenomenon is caused by the $100,000 call option price appreciation being larger than the $140,000. While a Bitcoin price increase to $65,600 is quite relevant for a $100,000 option with six months left, it is not so much for the $140,000 one.

Countless strategies can be achieved by trading ultra-bullish call options, although the buyer doesn’t need to wait for the expiry date to lock in profits. Thus, if Bitcoin happens to increase by 30% in a couple of months, it makes sense for this call spread holder to unwind their position.

As shown in the example above, if Bitcoin reaches $75,000 in June, the buyer can lock in a $23,000 net profit by closing the position.

While it’s exciting to see exchanges offering massive $100,000–$300,000 expiries, these figures should not be taken as precise analysis-backed price estimates.

Professional traders use these instruments to conduct bullish but controlled investment strategies.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Credit: Source link

Bitcoin (BTC) now accounts for less than 60% of the total cryptocurrency market capitalization, heralding the arrival of “alt season 2.0.”

In a tweet on March 29, analyst Filbfilb, co-founder of trading suite Decentrader, announced that conditions were finally right for a fresh altcoin surge as their total market capitalization is hitting new highs of nearly $750 billion.

Highlighting the current BTC/USD spot price, the combined altcoin market cap in U.S. dollars and Bitcoin’s market cap dominance, Filbfilb summarized the market in what will be music to the ears of altcoin traders everywhere.

“Alt szn,” he commented, conjuring a common nickname for the phenomenon of altcoins rising when Bitcoin cools or consolidates after a price surge of its own.

“Alt season” has been a full three years in the making. As Cointelegraph reported, expectations of a broad altcoin resurgence have long been high but ultimately left unfulfilled.

Now, however, with Bitcoin consolidating after hitting all-time highs of $61,700, circumstances appear to have played into traders’ hands.

At the time of writing, Bitcoin’s market cap dominance was 59.4%, its lowest since late October 2020.

The latest catalyst is arguably Visa, which on Monday announced that it would support stablecoin USD Coin (USDC) for settlement, thus leveraging the Ethereum blockchain. ETH/USD saw a modest 4.8% uptick in response, with the market cap share of Ether (ETH), the largest altcoin, still in decline versus January.

Zooming out, the foundations are nonetheless being laid for what Cointelegraph analyst Michaël van de Poppe expects will be a “very bullish” summer for altcoins, particularly as the market capitalization has been breaking new highs, nearing $750 billion. “Ethereum is going to surprise everyone massively,” he

Previous price forecasts for ETH/USD have included $5,000 and even $10,000 as a mid-term estimate.

“Altcoins look great,” fellow analyst Scott Melker added.

For Bitcoin, meanwhile, signs of a bullish comeback remained muted Monday after markets hit the buffers at February’s all-time highs of $58,300.

Intraday activity was nonetheless strong, with the pair up by over 4% in the past 24 hours.

Among market participants, talk thus turned to whether last week’s bounce off $50,000 represented a definitive price floor in the ongoing consolidation period.

“It could very well be that the BTC bottom is in,” popular Twitter account Rekt Capital estimated on Monday.

“If this is indeed the case, then this means that $BTC bottomed after a two-week retrace for the second time this year. Average Bitcoin retrace in 2017 was ~16 days.”

As of publication time, BTC/USD circled $58,000, showing resilience in what is the start of its final resistance block before entering uncharted price territory once again.

Credit: Source link

On Feb. 19, Bitcoin’s (BTC) market capitalization surpassed $1 trillion for the first time. While this was an exciting moment for investors...