Monday, 30 November 2020

Jobs impact of curbs on fixed-odds betting terminals ‘overstated’ | Gambling

Punters lost £700m less on gambling machines in the year after fixed-odds betting terminals (FOBTs) were reined in but industry predictions of mass job losses if ministers went ahead with the policy have not materialised.

As the gambling regulator released fresh data charting the impact of curbs on the roulette machines, campaigners said the figures showed that ministers poised to launch a wide-ranging review of gambling laws should beware industry forecasts.

Before last year’s decision to slash the maximum stake on FOBTs from £100 to £2, gambling lobbyists repeatedly warned that a cut could force 4,500 shops to close at a cost of 21,000 jobs.

But figures for the year to the end of March 2020 show that the number of high street bookmakers decreased by 639 to 7,681 in the first full year with reduced FOBT income.

The 7.5% decline is partly a result of gambling firms wooing customers online, where its costs are far lower than running bricks-and-mortar stores. The migration was already causing the UK’s network of high street bookmakers to shrink by about 3% a year.

Matt Zarb-Cousin, who campaigned against FOBTs and now advocates for broader reform via his Clean Up Gambling group, called on ministers to take industry claims with a pinch of salt as they consider an overhaul of gambling laws.

“This shows the predictions of doom from the bookmakers were dramatically overstated. Crying wolf won’t help their credibility in the upcoming gambling review.”

The Gambling Commission’s figures show the extent to which gamblers’ spending has changed since £100-a-spin FOBTs were reined in, with punters losing significantly less overall.

The amount lost on fixed-odds betting terminals tumbled from £1.16bn to £12m in the year to the end of March 2020, as the vast majority of FOBTs were rewired to offer lower stakes “B3” games.

B3 spending jumped from £1.1bn to £1.5bn as a result, indicating a significant switch to £2-a-spin products, where average loss rates are similar over time but huge, potentially life-altering one-off losses are much less common.

Overall, gamblers’ spending on machine-based betting in bookmakers fell by £700m to just under £2.1bn. Coupled with the effects of 11 days of coronavirus lockdown to the end of March, the 26% fall in machine income sent bookmakers’ revenues down from £3.26bn to £2.4bn during the year.

The land-based casino industry supported the FOBT cut, something bookmakers have previously said indicated that casino owners hoped to pick up business from players seeking high-stakes roulette elsewhere.

But casinos do not appear to have benefited, suffering a slight decline in income to just above £1bn.

Online casino betting increased by £100m to the highest ever figure of £3.175bn, in line with long-term trends. The biggest increase in spending came in the fast-growing online sports betting category, where punters lost a record £2.3bn. The National Lottery also enjoyed a significant increase, up by more than £300m to £3.4bn.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/11/jobs-impact-of-curbs-on-fixed-odds-betting-terminals-overstated-gambling/

Record gold outflow ‘isn’t going into ripples’ — only Bitcoin, says fund manager

The ongoing Bitcoin (BTC) rally has primarily been driven by institutions, analysts say, with metrics such as CME’s open interest and Grayscale’s assets under management (AUM), supporting this narrative.

At the same time, the gold market has seen large outflows in recent weeks. On Nov. 24, independent financial researcher Jan Nieuwenhuijs reported that gold saw its largest weekly outflow in history.

Largest outflow from gold ever. pic.twitter.com/Re4o3PHrel

— Jan Nieuwenhuijs (@JanGold_) November 23, 2020

The timing of the heightened level of outflows from the gold market is noteworthy because it comes after the entrance of major institutional investors into the Bitcoin market.

Cointelegraph reported that Guggenheim Partners, which manages $275 billion in assets, is the latest institution to show interest in Bitcoin.

What does this mean for Bitcoin?

In the medium to long term, the inflow of institutional capital into Bitcoin could lead to two key trends.

First, Bitcoin could see a more sustained uptrend that has emerged since September. Institutions, especially those gaining exposure to BTC through the Grayscale Bitcoin Trust, are likely accumulating BTC with a long-term strategy.

Some long-time Bitcoin investors, who had gold positions for prolonged periods, have also started to allocate their capital fully into BTC. Raoul Pal, the CEO of Real Vision Group, said:

“Ok, last bomb – I have a sell order in tomorrow to sell all my gold and to scale in to buy BTC and ETH (80/20). I dont own anything else (except some bond calls and some $’s). 98% of my liquid net worth. See, you can’t categorize me except #irresponsiblylong Good night all.”

Second, fund managers say that this could make Bitcoin even more dominant in the cryptocurrency market. Currently, the market cap of Bitcoin accounts for 63.83% of the global cryptocurrency market’s valuation.

Kyle Davies, the co-founder at Three Arrows Capital, one of the largest funds in the cryptocurrency sector, said:

“No one goes gold -> $BTC -> alts This year has seen big high net worth inflows from USD or gold to BTC. This is not retail. These guys aren’t going into ripples.”

The near-term trend of BTC remains uncertain

Bitcoin has seen strong momentum throughout the past three months, barely seeing major corrections.

During previous bull cycles, it’s not uncommon for BTC to see 30% pullbacks, and the recent run is yet to post a major downturn. But, in the near term, on-chain analysts say that BTC could be braced for a deeper drop.

Ki Young Ju, the CEO of CryptoQuant, said that whales are keeping more BTC on exchanges than in the past few months. This could indicate that whales could sell more BTC in the foreseeable future. He said:

“The fact that whales don’t withdraw means that $BTC is available for selling. If whales think the price will go up, they’ll withdraw $BTC a lot. I don’t know when it’ll start, but if the price drops, whales will react to the price and make high volatility.”

Whether the buyer demand from institutions and their Time-weighted Average Price (TWAP) algorithms would counter the selling pressure from whales would likely dictate the short-term price cycle of BTC.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/11/record-gold-outflow-isnt-going-into-ripples-only-bitcoin-says-fund-manager/

Don’t Get Hoodwinked by Hidden Bitcoin Trading Fees

Traders are flocking to Bitcoin in search of digital gold, but the journey can be costly and confusing, with hidden fees and cumbersome interfaces, making it difficult to navigate the market successfully.

eToro makes cryptocurrency trading costs crystal clear. There are no fees buried in the fine print, and an intuitive user interface helps you avoid expensive misclicks.

Be aware of hidden fees

On eToro, trading costs are contained in a single charge. The percentage of the spread for buy and sell is the entire cost of the trade — zero fees, no hidden fees, nothing!

Depositing US dollars on eToro is completely free, and a flat fee of $5 is charged to cover the processing cost of withdrawals. If you are depositing in another currency, an FX conversion fee may apply, but costs are made clear in advance, unlike other platforms that often levy unstated conversion fees.

| Fee example | |

| Initial investment | $2,000 USD |

| BTC buy price* | $20,000 USD |

| Position size | 0.1 units |

| eToro typical spread for BTC | 0.75% |

| Total round trip (buy and sell) fees: | $15 USD |

| (0.75% *20,000 USD * 0.1 units) |

*Example price

To buy and sell 0.1 unit of Bitcoin in a round trip when the price is at $20K, you would pay a single spread fee of 0.75%, or $15 USD.

Most other trading platforms charge a set commission as a percentage of the position size. But high spreads — the difference between the buying and selling price — mean the real cost is higher.

In addition, account maintenance and inactivity fees can be hidden away in the terms and conditions, eating into profits and adding to losses each time you place a trade.

Even depositing funds can cost up to 5%, with traders often paying their card service providers significantly more for the convenience of paying by card, leaving them with a loss before they have even started trading.

When the time comes to withdraw, traders can be hit with more costs, paying super high flat fees to send funds back to a bank account.

With eToro, we take care to do things as clearly and as simply as possible — you pay only for the spread, with no additional transaction fees.

Smoothly navigate the market

Instead of a complex interface that leaves new traders one misclick from disaster, eToro offers a seamless user experience.

Traders can engage with the basic mechanics of the Bitcoin market through a streamlined process that begins the moment funds are deposited.

eToro is one of the only exchanges supporting PayPal, along with multiple other deposit methods, including bank transfer, card payment, Skrill, Neteller, WebMoney, and Yandex (depending on region). With funds on the platform, you can then buy and sell easily through an intuitive and user-friendly interface, making managing your portfolio completely painless.

To test the water, eToro gives you a free $100,000 demo account. This lets you build a virtual portfolio and test innovations like copy trading, risk free.

This unique trading toolkit, combined with clear pricing and an intuitive user interface, means Bitcoin trading is no longer costly and confusing.

This ad promotes crypto investing, which is highly volatile and unregulated. Trading cryptoassets with leverage is regulated and comes with a high risk of losing money. Buying cryptoassets is unregulated in most EU countries and therefore is not supervised by EU regulatory frameworks and carries no EU protections. Your capital is at risk.

Image by Christel SAGNIEZ from Pixabay

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/11/dont-get-hoodwinked-by-hidden-bitcoin-trading-fees/

Aave Surges 20% as DeFi Coins Begin Resurgence, Following Ethereum Rally

Top decentralized finance (DeFi) coins such as AAVE are outperforming over the past day. While Bitcoin and Ethereum are both up massively today, AAVE is up 18.5% in the past 24 hours alone. This performance makes it the best-performing digital asset in the top 100 by market capitalization. AAVE is now up by approximately 10% on the week, per CoinGecko data.

This rally highlights a growing/continued interest in DeFi, which has continued to gain fundamental strength despite shaky price action. The number of DeFi users is soon expected to reach one million, by some estimates, making it one of the first crypto technologies to be adopted by many.

Aave stands to benefit from this trend as it sits at the core of the ecosystem as a money market for lending and borrowing.

Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom

AAVE Erupts 20% Higher

AAVE is up 20% in the past 24 hours alone amid strength in the price of ETH.

Ethereum has gained around 5% in the past 24 hours, pushing to $580 after consolidating under $540 for a number of days.

These gains to be trickling down to top Ethereum-based coins such as AAVE.

AAVE is one of the leading Ethereum-based, DeFi coins, touting a valuation of $890 million. It is a governance token that allows users to govern the Aave protocol; the coin is also used as a backstop for the protocol in case of a glitch.

This latest leg higher comes as Aave has set a key milestone. As pointed out by Marc Zeller, who is part of the Aave core team:

“The 3 comas club has a brand new member with the @AaveAave Flash loans. 1 Billion thanks to all the devs being pioneers of innovation, @DeFiSaver @fifikobayashi, and all the others. Can’t wait to see y’all all experiment with Seamless Loans made possible with @AaveAave v2.”

Related Reading: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin

DeFi Back in Vogue

This rally comes as the fundamentals of the DeFi space have continued to improve at a rapid clip.

According to top data tracker DeFi Pulse, the total locked value of coins in decentralized finance contracts just surmounted $14 billion.

This is up from approximately $500 million, where this metric started in 2020.

Analysts are optimistic that there will be further growth in the DeFi space amid positive technological and price developments. This should result in further growth in the values of top coins pertaining to the space.

Related Reading: 3 Bitcoin On-Chain Trends Show a Macro Bull Market Is Brewing

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Aave Surges 20% as DeFi Coins Begin Resurgence, Following Ethereum Rally

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/11/aave-surges-20-as-defi-coins-begin-resurgence-following-ethereum-rally/

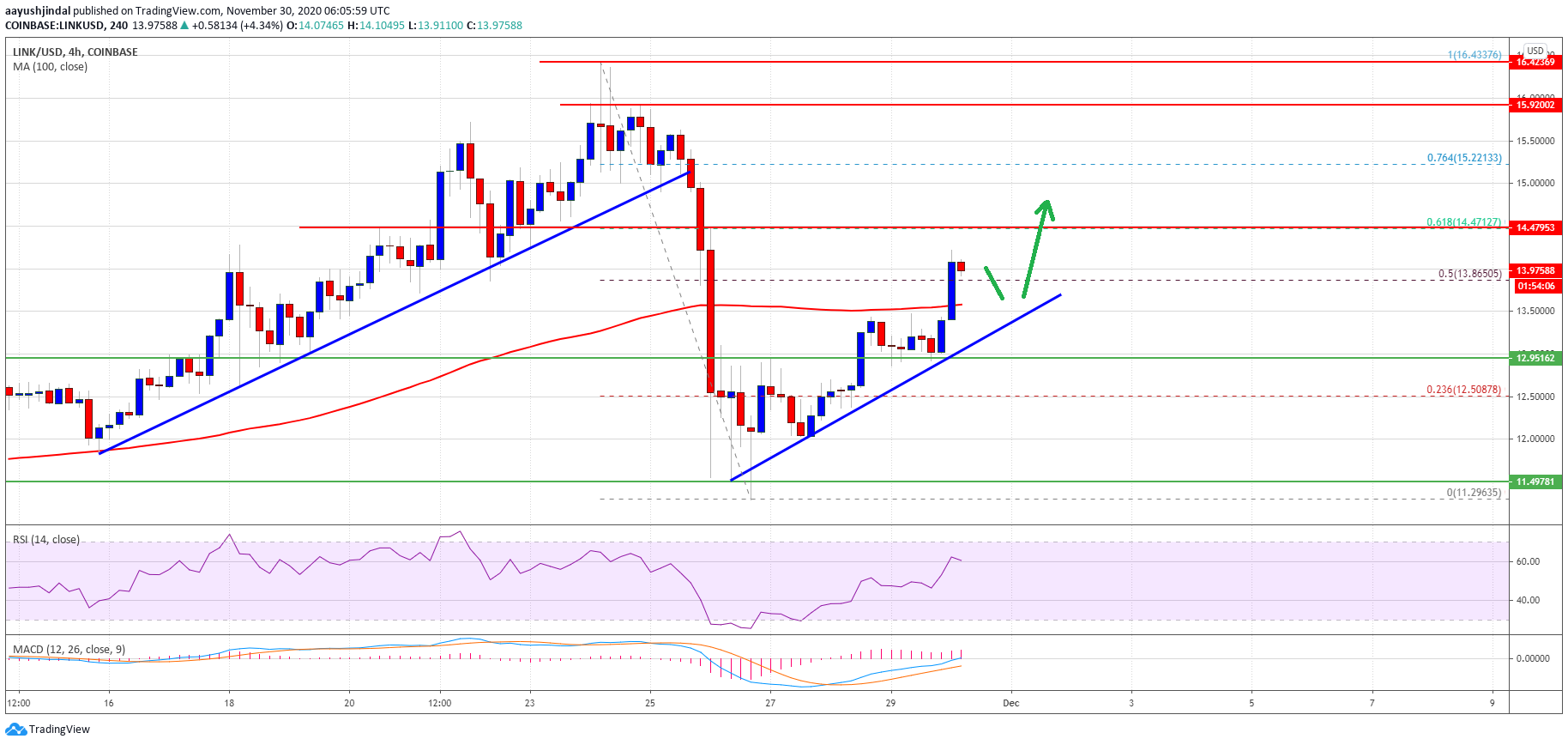

Chainlink (LINK) Looks Ready For Another Leg Higher Over $15

Chainlink (LINK) remained stable above the $11.50 support and started a fresh increase, similar to bitcoin. The price is now trading above $13.50 and it could continue to rise above $15.00.

- Chainlink token price regained traction and climbed above $13.00 against the US dollar.

- The price is now trading above $13.50 and settled above the 100 simple moving average (4-hours).

- There is a key bullish trend line forming with support near $13.50 on the 4-hours chart of the LINK/USD pair (data source from Kraken).

- The price is likely to continue higher above the $14.50 and $15.00 resistance levels.

Chainlink (LINK) Is Gaining Momentum

This past week, we saw a sharp downside correction in bitcoin, Ethereum, ripple, bitcoin cash, chainlink (LINK), and other major altcoins. LINK price dived from well above $15.50 and declined below the $13.50 support.

There was also a break below the $12.40 support and the 100 simple moving average (4-hours). Finally, the bulls were able to protect the $11.50 support zone. A low was formed near $11.29 and the price started a fresh increase above $12.00.

There was a break above the $13.00 resistance and the 100 simple moving average (4-hours). LINK price surpassed the 50% Fib retracement level of the downside correction from the $16.43 swing high to $11.29 swing low.

Source: LINKUSD on TradingView.com

The price is now trading nicely above the $13.85 resistance. There is also a key bullish trend line forming with support near $13.50 on the 4-hours chart of the LINK/USD pair. On the upside, the bulls are likely to face hurdles near the $14.50 level.

The 61.8% Fib retracement level of the downside correction from the $16.43 swing high to $11.29 swing low is also at $14.50 to prevent gains. A clear break above $14.50 could open the doors for more gains above $15.00 and $15.20.

Downsides Limited?

An initial support for chainlink’s price is near the $13.65 and $13.55 levels. The first major support is forming near the $13.50 level and the trend line.

If there is a downside break and close below the $13.50 support zone, there is a risk of a bearish move towards the $13.00 support level or even towards the $12.50 level.

Technical Indicators

4-hours MACD – The MACD for LINK/USD is now losing momentum in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for LINK/USD is currently well above the 50 level.

Major Support Levels – $13.65, $13.50 and $13.00.

Major Resistance Levels – $14.50, $15.00 and $15.50.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/11/chainlink-link-looks-ready-for-another-leg-higher-over-15/

Bubble or a drop in the ocean? Putting Bitcoin’s $1 trillion milestone into perspective

On Feb. 19, Bitcoin’s (BTC) market capitalization surpassed $1 trillion for the first time. While this was an exciting moment for investors...

-

MicroMillions is back! Credit: Source link source https://cryptonews.wealthsharingsystems.com/2020/11/micromillions-series-now-running-o...

-

November 16, 2020 Will Shillibier The inaugural PokerStars European Poker Tour Online festival is drawing to a close, with Day 1 of the M...

-

October 28, 2020 They’ve been teasing us for months, and now Circa Las Vegas opens their doors of their “adults only” resort down o...