Thursday, 31 December 2020

4 reasons why the top 15 richest Bitcoin wallets still matter in 2021

Transparency is one of the most intriguing aspects of cryptocurrency and it was this openness that drew many early supporters to Bitcoin (BTC).

Blockchain technology makes all information associated with the network’s operation accessible for anyone interested in taking a look. Every known address, transaction, fee paid and other details relating to multisignature and SegWit usage is out in the open.

The top 15 wealthiest Bitcoin addresses have always been the centerpiece of attention for several reasons. Some crypto researchers habitually sort through the top addresses searching for the footsteps of Bitcoin creator Satoshi Nakamoto. Others study data to track the maneuvers of crypto whales and predict market manipulation that results in volatile price swings in the Bitcoin price.

The top addresses have even caught the eye of government agencies like the United States Internal Revenue Service as well as the Treasury Department.

In fact, entire companies specializing in obtaining additional information on cryptocurrency addresses and their potential associations have been formed. It’s no secret that the U.S. Internal Revenue Service hired Chainalysis and Integra FEC, two crypto analytics firms, to track transactions.

More recently, under Treasury Secretary Steven Mnuchin, the Treasury Department is considering whether or not a rule on self-hosted cryptocurrency wallets is required. If approved, these changes emphasize the importance of privacy for market participants.

Addresses are not the same as entities

As shown above, the top 15 addresses hold 1.07 million BTC, or 5.7% of the outstanding Bitcoin supply. At the current $26,500 price level, this equals $28.3 billion. While this is a large amount of Bitcoin, it’s also worth noting that BTC’s aggregated volume on spot exchanges surpasses $5 billion per day.

It’s important to note that an address’s initial deposit date does not mean that the entity owning the address first acquired coins on that day. The coins could have been sent from another address belonging to the same entity. Therefore, the dates showing first funds being sent to 11 addresses since only 2018 do not prove that the address holders are new to the sector.

It is also worth noting that none of the top 15 addresses are rumored to be Satoshi’s holdings. Researcher Sergio Lerner has shown that the blocks Nakamoto mined contain unique patterns known as Patoshi patterns. Although that mined BTC has yet to be moved, it was not allocated to a single address.

The top 100 addresses concentrate 15.7% of the total supply, which is rather impressive compared to the level of distribution seen in traditional markets. For example, the top 20 funds owning PayPal shares hold a combined 19.7% of the total share supply.

Five of the 15 most significant addresses are known addresses from exchanges, indicating that the apparent concentration does not exist in a way that can be attributed to crypto whales.

In addition to exchanges holding large sums of Bitcoin in wallets, some custodians also accumulate BTC for numerous clients in wallets spread over multiple addresses with large sums.

The top addresses are recent holders and non-SegWit-compliant

An impressive eight out of the top 15 addresses have never withdrawn a single satoshi. Excluding the five exchange-related addresses, only 20% have ever moved their coins. This indicates a strong prevalence of hardcore holders.

Moreover, 11 of the 15 addresses were first used less than three years ago. Multiple reasons could be behind this oddity, including improved security measures, a change of custodian, or different ownership structures.

Only two out of the top 15 (and three in the top 200) addresses are Bech32 SegWit-compatible, which can significantly reduce transaction fees. This indicates that users are resistant to change despite the clear benefits of cheaper transactions. Even more interesting is that the Bitfinex cold wallet ranked second on the list is the only one that has ever had an outgoing transaction.

A few mysterious addresses keep stacking

The third wealthiest address is something of a mystery, as it contains an untouched 94,506 BTC. The address made headlines back in September 2019 after Glassnode reported that 73,000 of the BTC in the wallet had originated from Huobi.

Many analysts suggested that these coins were connected to the Plustoken Ponzi scheme, but these rumors were proven wrong after the Chinese police seized 194,775 BTC on Nov. 19 from the fraudulent exchange.

Aside from the fourth-largest wallet containing 79,957 BTC since March 2011, 20 of the top 300 addresses are over nine years old. Although no one can prove that these funds have been lost, most assume so.

Those untouched coins amount to 313,013 BTC, and only one address has ever transacted out since origination. Thus, apart from F2Pool’s 9,000 BTC held at address 1J1F3U7gHrCjsEsRimDJ3oYBiV24wA8FuV, there is a very good chance that the funds from the other addresses are effectively lost.

The fifth-ranked address shown above was created in February of 2019 and, at origination, was listed as the 81st-largest address. Since then, it has been accumulating regularly, adding from as low as 1 BTC in December 2019 to 4,100 in a single transaction in June 2019. Despite being a large accumulator, it has made seven transactions out, ranging from 786 BTC to 3,000 BTC. Maybe even whales have bills to be paid.

There are precisely 100 addresses first used between Nov. 30, 2018 and Dec. 18, 2018 containing around either 8,000 BTC or 12,000 BTC each. These addresses are commonly attributed to Coinbase Custody. Amounting to 881,471 BTC, the addresses’ funds equal to 96% of the exchange’s cold wallet, according to chain.info.

The new whale local top theory

Every investor has a gut feeling that the arrival of new Bitcoin whales is crucial for a sustained rally, even though there has never been hard evidence of this effect until now.

There is a constant flow of new addresses entering the top 300. For example, 16 of them received their first-ever deposits within the past 30 days. Once again, this is not necessarily a new entity but an address receiving its first-ever BTC.

Although it is uncommon, sometimes gaps of 50 or more days occur without newcomers joining the top 300. Coincidentally, these periods mark the end of rally periods, and a healthy correction usually follows.

Precisely zero of the top 300 addresses were initially used between Nov. 28, 2019 and Feb. 09, 2020, when BTC went up by 35%. Oddly enough, the market plunged 52% over the next 32 days.

A similar effect happened between Oct. 18, 2017 and Dec. 11, 2017. During this period BTC rallied 193% while none of the top 300 addresses were newcomers. A 34% price drop occurred over the following 36 days.

Before that, none of the top 300 addresses were initiated between April 20, 2017 and July 07, 2017. Meanwhile, BTC soared 111%, while a 24% crash has also followed this period over the course of nine days.

So far, history has been proving that the new whale theory makes sense: The market rallies during prolonged periods of fewer new addresses making it to the top 300 holders list, as it indicates accumulation by entities that already had position. On the other hand, new whales could be driven by fear of missing out, which usually indicates local tops.

Therefore, it makes sense to monitor the top addresses and on-chain data to gauge potential corrections.

Every time large deposits enter exchanges, this indicates a potential sell order and is deemed bearish by traders. These movements are then compared to BTC price tops and bottoms in an attempt to find some correlation between whale transfers.

Whenever the market is rallying and miners, in turn, reduce selling, analysts expect a price correction once they start moving coins again. To put things in perspective, this is 6,300 Bitcoin per week that needs to be absorbed by the market to avoid price impact.

Now that institutional investors have “arrived,” investors will be itching to see whether their inflow in 2021 will continue to absorb newly minted BTC.

While 2021 is looking pretty bullish for the crypto market, there is always an unexpected price crash that often results from the government threatening regulation.

This means it will still be important for savvy investors to follow the top 15 Bitcoin addresses and the movements of crypto whales in 2021.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2021/01/4-reasons-why-the-top-15-richest-bitcoin-wallets-still-matter-in-2021/

The Legacy System Vs. The NFT Metaverse

This is an intermediate to an expert level article on NFTs. If you only want to understand the first things about it, scroll to the end, or alternatively find a beginner level feature.

Everybody wants big-league gains but ain’t willing to do what it takes to deserve it.

We have a pandemic level cultural illiteracy and incentive model problem, threatening the promising start of the crypto and NFT art movements. The, mostly unconscious, skewed foundational motivation bends will soon bite it in the butt, but some of us can pre-warn some people open to listening.

The whole thing stinks of the 2017 ICO boom so much that, while I like, and even need to party, I can already hear the next three years of ‘NFTs are a scam’ bile happening due to the ongoing, somewhat self-inflicted, starry-eyed, and delusional stripper money excitement.

I’m an artist, not a critic, but there isn’t anyone here to do this job, so without mentioning names, I’ll give it a go. This hopefully will show what it takes, should a real emerging critic take the job, and why I shouldn’t do it, even if I can. It’s a tall order though, as they will need to have an understanding of art history, economics, technology, and the culture wars. The reason I can say this is that I had to figure out why the previous experiences in the legacy art world were so hellish for an innovator, and why I was equally optimistic three years back about crypto.

Sure we are the beginning of a digital revolution, but it’s increasingly, ideas-wise, looking like old mediocre bullshit in a new wrapper celebrating the same old money hype – at the expense of its actual potential impact of liberating a whole class of creative people. This article is an attempt to raise the bar of the current conversation resolution in a culturally significant way, so it will undoubtedly ruffle some feathers.

I don’t claim to be the most technically savvy person, and that part of NFT’s seems to be doing fine. Some say only trust the swarm intelligence, and I would if I saw more evidence of it from the philosophical side. I’ve fought for too damn long and too damn hard just to let this slide – so here goes a hail Mary. If nothing else, consider it a cathartic last thing of 2020, from which we can all bounce into a further upward cycle well.

Release Us From Metaverse Spin

So no one needs to be on the defense any more than they have to, please allow me to state why this is caused by all of us together, and it started before any of us were even born. It’s not the fault of the artists, the collectors, curators, absent critics, corporations, the institutions, the ideologies, the banking system, or even the Jungian shadow in us all – well, maybe quite a bit the last one.

Defiance of authority is cool, but is something being lost in translation?

As most of the sales are now focused on the US, we need to acknowledge important historical, ideological & world cultural aspects of recent centuries, and decades. As an outsider familiar with American culture, this is easy to see. In many ways, I feel more entrepreneurial than European, so this is not coming from a hater perspective. I grew up with Ghostbusters, The Blues Brothers, Star Wars, James Brown, and much more like the rest of us – perhaps relating to it more than most in Finland.

The rebellious innovation nature of the American culture is, that what is seen as an inheritance of Kings & Queens, is elitist crap, and we can make billion-dollar companies wearing jeans and t-shirts. This is especially true in the Silicon Valley tech culture. It is now also famous for wanting to look good for the cultural left while strip-mining everyone’s data, making untold fortunes without paying taxes & limiting freedom of speech rights. There is a simultaneous disdain for so-called ‘high-culture’ as well as a yearning for credibility, which is now causing cognitive dissonance, and despair for the rest of us.

The Premature Death & Potential Rebirth Of The Word NFT Art

One of the first things you learn in art school you learn – or you used to learn before the culture wars took it over – was that this is not a pipe. The above is a picture of a pipe. The image points to something and is not the thing itself. Even if it has fancy light effects and you make it into a short animation. The Derrida‘s of the world, however, made the signal more important than what it was pointing to, so here we are.

The Rene Magritte work points to the naive realism now taking over the movement almost fully. Due to the western neo-Marxist revolution, this is now elitist talk in Europe, too, but is very connected to evaluating NFT art, and for it to grow into adulthood. The ‘neo-comms’ of course don’t like it that there is honest talk of their revolution, so likely some will attack it as a conspiracy theory by right-wingers, and those clueless of its influence. I’ve watched all the same activist documentaries, were heartbroken over them, and more, but this is way out of hand now. To some, this camouflage crap simply won’t fly anymore. The price these Children of corn are asking for letting them freely further erode western society, alongside the financial fiat money system, is simply too high. It’s not their fault, but they aren’t capable of knowing what they were indoctrinated into. Before calling me a right-wing pundit, however, please at the very least check out this solar energy activist art project called LUX, which took me 3-years to make. Entering crypto after making it, balanced a whole bunch of things out, that you simply don’t learn in a left-wing university, like mine was.

Vesa, what the hell are you on about?

We are just getting started with NFT’s, and it’s going great!

No one needs critics. They are so negative.

Right?

The Iceberg NFT Analogy

To trust in naive optimism is cute, but if we want those big-league gains to come from something not resembling intellectual death and/or pure wash trading, the culture wars underneath the visual part of this emerging space need to surface. We have some amazing examples of spearhead expressions, sure, but not all is as presented. We now evaluate, and mostly reward the works presented by the artists on an embarrassingly superficial level, leaving out the spectrum almost entirely what the underlying culture is. Of course, due to what collectors now recognize as ‘brilliant’ are mostly ideas done to death in the legacy art world, and has anyone innovating actual new things with authentic voices rolling their eyes. Just because you tokenize an old idea, calling it genius is what keeps us from getting credibility for actual innovation. You also can’t wash trade like crazy, while saying blockchain solves old world problems.

I’ve made myself persona non-grata in many circles for having pointed some of this out since the beginning. Artists, collectors, and platforms are made of people, and people seldomly like critique – especially if it comes from an artist – so the sycophantic cycle is now on autopilot. It’s just that someone has to state the obvious flaws of it all since we don’t have any actual new wave, integral, NFT critics in this space yet.

Just know, btw, that this comes from the perspective of someone who innovated in the legacy system for a decade before crypto, at a great expense to my finances, mental health, and faith in humanity. It really was the worst, jaded, insider world designed to keep innovation out, rather than embrace it. This is part of the reason I’m writing all this. I’m seeing the same crap enter this world now. I’m sure I still have many blind spots, but my on-the-spectrum Aspergers allows me some true defiance to this direction.

Camille Paglia, the The Dark Women, Stratford Festival Forum lecture on Youtube.

Nobody Is an NFT Critic

To substantiate the love of US from an intellectual standpoint, much of my education comes from learning the lion’s share of my mindset from arguably one of the most comprehensive philosophers of all time, Mr. Ken Wilber. He is the father of integral theory, which is by far one of the most credible models for us to get out of many of the jams we are currently in. The trouble is, most haven’t even heard his name. He, of course, borrows a lot of his insights from the great Eastern traditions, so there is a merry-go-round in the spirit of Bruce Lee going on with him. If someone says the word integral, and it won’t include the whole world, that ain’t it.

Spirituality, as pointed out by Sahdguru, is likely even more corrupt of a word than art, but just because the word has eroded, it still keeps pointing to the real thing. Without this grounding, I would have surely been beaten down by this world many times over by now. The reason this matters is that art has its origins foundations in world religions, and we all know what has happened to the institutions of that realm. If you don’t think this has anything to do with NFT’s, please allow me to elaborate.

The other, massively important person to follow, is another US native Camille Paglia. She has outlined the problems of the education system, cultural decline, and intellectual suicide for decades. We simply have nothing like these two as any kind of influence on our emerging NFT scene, and we should. They are not the low-resolution perception on what a bad, technologically clueless, financially illiterate, and void of vision critics of culture are now seen as.

There are phenomenal use cases of visualization and tech adoption happening in the NFT space. It has legitimate doubts about the legacy world entering, embracing, or imposing any of its ways into it. Like Camille says, the current art establishment only leaves out the religious roots of art, ancient Egypt, antiquity, the enlightenment, societal & natural sciences, non-propagandist history, and political nuance from its current evaluation model.

However, this is what is now being used as a watered-down version of credibility footnotes to know which artists are ‘innovative’ from a cultural standpoint. It leaves many with real innovation, substance, and authentic voices completely out to dry. I don’t only mean those maybe thinking about entering, but some of us still sticking around.

“At particular times, a great deal of stupid people have a great deal of stupid money” – Walter Bagehot, Economist, 1859

The problems from the last ‘developments’ of the legacy art world were brilliantly outlined by the BBC “The Great Contemporary Art Bubble” documentary. It’s about how many newly rich people wanted shiny things, and the art world printed their fiat crap to suit them – making billions in the process. The second part is the cultural Marxism embrace, largely due to the nihilistic financial future of us all, as the monetary system started its death spiral in 2008.

Let’s collab, Bro!

Let’s get another disclaimer out the way. I have nothing against great collaborations, nor being communally social. I come from a film background, in which you need 100 people to pull something off. If people can compensate for the lacking skills they have in certain areas, they can do increasingly incredible things.

The inheritance of the legacy system degeneration is that the artists are now meant to be seen as people who only help each other – while actually struggling towards the top sales in a super limited collector space mostly ignorant of art. The inherent conflict needs to be excluded and not acknowledged, as well as the pandering to people who don’t know what to demand for their money. The number of knives stuck in various backs, including mine behind the scenes, aren’t stories they write about on Cent WIP’s or community Whatsapp groups. It’s straight from the communist playbook of ‘what we will say and what will actually happen’. The whole output of the Intellectual Dark Web will help you understand this paradigm, should you want to get it on a deep level.

This leads me to the collaboration hype model, which is now prominent, and a hangover inheritance of the post-modern neo-communists hijacking the cultural space, in which art almost solely serves ideologies and causes in the big picture. There are beautiful parts about many collaborations in crypto art, but not many understand where the need emerges from. This is why we have artists making statements like ‘everything is political and about oppressive power’. It’s the death of art, and it’s been going on for a while, from a freedom of expression of the individual point of view. There are many reasons to write this, but what is now happening almost entirely unnoticed, is that the worst aspects of the legacy corruption, are now seen as intellectual footnotes of validation to a space trying to entirely re-invent the wheel. They look down upon everything in the legacy system, quite frankly, because they don’t understand it and vice versa. This is why the below the water line iceberg matters. You see, these corrections will eventually come from the outside if we don’t do it from the inside. We won’t have a say in the matter, and it will be a whole lot more embarrassing if it comes from the outside in.

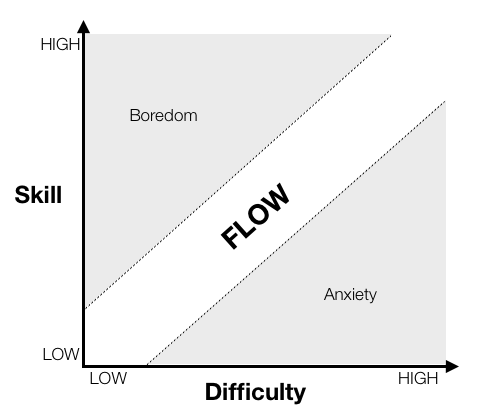

The Flow State

You see, I can only be seen as being supportive and appraising of my fellow artists, even if they blatantly rip me off, use absolutely done to death concepts, fool investors with facepalm level ideas, etc. The reason I want critics to come in is that someone has to do the dirty work of separating the actual seeds from the sea of dry intellectual land, or we all suffer. Anyone who knows what has been done to death, won’t be impressed by something that was revolutionary 50-years back. The more accurate pointer can’t be me, as that would cost me even more than this has already cost me now. It would further alienate investors, make enemies out of my fellow artists, and give me a ‘negative aura’. The truth is, I’ve even been so nice that I haven’t named the other artists I could easily prove ripped off my concepts, art, and process thus far.

The truth about human development is that we require both challenge and support to grow in an equal measure. Inside the community, we have plenty of support for one another, but all emerging critics have been removed as soon as they started pointing things out. There is plenty of real challenge of finance, education, and platform development, as well as artistic expression progress, but we have come a long way. This is the real love coming from me to write this all. The quality improvement last year alone was a light-year leap from the previous.

Crypto killed the gallery star NFT by Moxarra Gonzales

The NFT Machine

The best way to describe the revolution is to juxtapose it with the arrival of MTV in the ’80s. The youth culture, opportunity, and feel of it swallowed all criticism, like the Dire Straights song, and birthed a creative renaissance. This time though, the context is much wider involving digital land ownership, digital art, digital permanent certificates for physical things, avatars, game items, brand collectibles, and things we’ve yet to imagine. This is not lost on me, but also, what the MTV culture started, was a rebellion that has now been done to death also. The culture rebelled so much, that it now hasn’t a clue about what it is rebelling against, leaving it feeling mostly just vacuous. The crypto art movement, for those of us who were there in the beginning, meant an army of artists fighting for a new money movement to help the world re-open its blocked arteries. The corporate overlords have now all but removed all traces of it in the Wikipedia page, and you can but wonder about the audacity this moderator does it with.

Neo-Conservative Elements in Art

I’m a nude bodypainting, tech & innovation loving, crypto, meme, and pop culture embracing progressive human, who adores various spiritual concepts. This said, the new rebellion has conservative elements, that are now the direction out of the nihilistic youth culture of the ’80s and ’90s continued to the opioid epidemic. As much as I love the 60’s counter-culture figures, they are mostly now, invalid for what real liberals actually need. The rigor mortis conservative relics still do, but they aren’t here to listen to anything I have to say anyway. The new liberals need financial literacy, crypto, Austrian economics, a balanced perspective, and some real patience with their own team.

“The only way to make sense out of change is to plunge into it, move with it, and join the dance.” – Alan Watts

Ends and Means

So, what have I done in order to feel like someone who can point this out? I actually managed, in the eyes of art history, to renew the process of portrait painting into a new visual language, and digital originals in 2008. That was also the year I made my first pricing innovation and was featured in Finland’s two top economic papers about it starting 2009. I’ve been a full-time crypto artist now for 3,5 years, with various pushes of boundaries, but my tokenized NFTs aren’t currently selling.

I was also left out of the recent Decrypt article on NFT innovators, and even my limited edition 1 ETH works aren’t currently flying off the shelves. If innovation is now only measured in money, I don’t know what to say. Some will think it’s just jealous talk. Nifty gateway won’t have me on their platform, and Async art denied me access too, despite the obvious compatibility. I wonder why because it’s not that they aren’t aware of my efforts. Is this more of a shame for the space, me, or both? Do you think any of this can actually be rectified?

I’m saying that to pre-empt some of the most vacuum filled criticisms laid towards the substance of this article, so you wouldn’t have to deal with the arguments. Is it all coming from an upset point of view? Perhaps some. But if you would have been in the trenches for as long as I have, paid the price I have, and having to watch your favorite new thing make massive side-steps – can you blame me? I’m as in love with this space as you are, but it’s really starting to become a one-way street for me.

Please consider this to cap this off. What the above quote from the Integral Institute feature from 2014 means, is that basically managed to integrate more expression, cultural significance, and innovation to my works that the biggest names in Western art history, now selling for hundreds of millions – as acknowledged by one of the rare professors left able to do the evaluation of that level. I also reached 300MM people with a project featured in that article due to its cultural impact. I climbed the heavyweight tallest mountain, only to find out almost no one cared. So this is all deeply personal, sure. You could say I’m furious at times.

So, what am I selling really?

No, seriously, I’m done writing culture.

No one paid me to do this.

I’m not claiming immunity to all things mentioned above.

Metaverse AND the Physical Space

I’m also building a physical studio space crossing over to the metaverse with the company Coloro. There are 9 of the 10 NFTs left to help support the build of it, now tokenized on Mintable. The link is to the second one, and this will soon get its own promotional article. The space in its raw form can be seen in this Brittany Kaiser interview with Hardforking, and if you want to further understand the NFT space, have a listen to this Encrypted episode with Ahmed recorded in Dubai a couple of weeks back.

Redemption digital art NFT for sale on Superrare

I think this article will age fairly well.

Stay cool, folks.

V E S A

Crypto Artist

Official Pages:

Crypto Art

Artevo Platform

Twitter Insta LinkedIn

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2021/01/the-legacy-system-vs-the-nft-metaverse/

Bitcoin Closes 2020 As Best Performing Asset Of The Last Decade

Today is the last day of 2020 — a year so many are ready to say goodbye to and never look back at. But for Bitcoin, the cryptocurrency is about to close out its most important year yet.

At the same time, the asset also closes the last ten years as the best performing asset since 2011, underscoring a decade of growth that is only just beginning. Here’s how Bitcoin stacked up against the rest of the world of finance over the last decade.

From Early Bitcoin Beginnings To Now

The Bitcoin white paper was first distributed in 2008, and the genesis block that began it all was mined in 2009. In 2010, the first well-known commercial transaction involving BTC and two pizzas took place.

But it was 2011 when the asset rose to over $1 and started to be widely used as a currency — primarily for transactions on the Silk Road dark web marketplace.

Related Reading | Analyst: Bitcoin Parabolic Trend Is “Close To A Breakdown”

From there, it has continued to be used as such but also has taken on many other use cases as its market cap has grown. Today, in 2020, institutions, billionaires, celebrities, and corporations are now buying BTC to store value and hedge against inflation.

Bitcoin's entire history of price action | Source: BLX on TradingView.com

How The Cryptocurrency Compares Over The Last Decade

From the asset’s early days in 2011 as an emerging form of peer to peer electronic cash to the current digital gold narrative, the price per BTC has grown to just under $30,000.

Data shows that the cryptocurrency has outperformed every other asset over the last ten years, with a staggering 6 million percent increase. This equates to over 200% annualized returns, with the next best performer being the Nasdaq 100 at just 20% annualized returns.

All assets compared in over the last ten years | Source: Charlie Bilello

Looking at it from the perspective that the asset has already grown from under $1 to $30,000 and over 6,000,000% gives the false impression that’s it’s too late to invest in Bitcoin. But because of the cryptocurrency’s potential and promise, it could ultimately reach prices of hundreds of thousands to millions per coin.

Related Reading | Bitcoin Dominance Doji: Why 2021 Could Spell Doom For Altcoins

Some of the most brilliant investors alive claim getting into Bitcoin even now is like investing in Google or Apple early. Just as many naysayers exist, however, but people often don’t agree with what they cannot understand.

Others have compared Bitcoin to the internet, and like that technology — including email, websites, and more — was all demonized at first and thought to never replace existing systems.

Is the same fate as the internet ahead for Bitcoin as the asset’s most important year and it’s first full decade beyond proof of concept stage?

Featured image from Deposit Photos, Charts from TradingView.com

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/12/bitcoin-closes-2020-as-best-performing-asset-of-the-last-decade/

Data Shows New Investors Flooded into Chainlink in 2020; Upside Imminent?

Over the past few weeks, Chainlink’s price action has been nothing short of lackluster, with the cryptocurrency failing to gain any serious momentum as investors widely shift their focus away from altcoins and towards Bitcoin.

This trend shows few signs of letting up anytime soon, as most major altcoins are all stagnating as BTC continues showing signs of strength.

Until BTC enters a prolonged consolidation phase or slides lower, there’s a strong possibility that it will continue gaining dominance over the market.

Despite this short-term trend being bearish for altcoins like Chainlink, data does seem to suggest that the cryptocurrency is as fundamentally healthy as it has ever been.

According to one analytics platform, Chainlink could be well-positioned to see some massive upside due to an ongoing accumulation trend amongst smaller network participants.

They also note that while its price has gravely underperformed BTC and other altcoins like Ethereum, its largest whales are still holding strong, with there being “no apparent whale sell-offs in sight.”

This could mean that once there is a rotation of capital away from Bitcoin and towards altcoins, LINK will lead the charge and see some massive upside.

Chainlink Stable in Lower-$11.00 Region as Altcoins Consolidate

Altcoins have extended their consolidation trends despite the recent strength seen by Bitcoin and even Ethereum.

Chainlink is a prime example of this, as the cryptocurrency has been trading sideways around its current price of $11.25. This is around where it has been trading throughout the past week.

It appears to be facing some resistance within the upper-$11.00 region, as this is where it found some massive resistance that slowed its ascent and caused it to slide back to its $11.00 support region.

Analytics Firm: LINK Whales HODL Strong as New Addresses Spike

Despite Chainlink’s lackluster price action as of late, the cryptocurrency’s whales are holding strong and are showing no signs of folding anytime soon.

Furthermore, an analytics firm recently noted that the number of new addresses holding and buying LINK has spiked as of late.

“A year ago, Chainlink’s top 10 whales held 70.7% of the total circulating supply of LINK. To close out 2020, they now hold 64.5%. This can be attributed to consistent new addresses being created on the network, & no apparent whale sell-offs in sight.”

Image Courtesy of Santiment.

The coming days should shed some light on how Bitcoin’s price action will influence Chainlink and other altcoins.

Featured image from Unsplash. Pricing data from TradingView.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/12/data-shows-new-investors-flooded-into-chainlink-in-2020-upside-imminent/

Why This VC Expects Altcoins to Boom as Bitcoin Rally Enters an “Extreme”

It’s no secret that Bitcoin’s recent parabolic rally has done little in the way of providing tailwinds for altcoins, with many seeing devastating losses against BTC as their growth stagnates.

This isn’t unprecedented, as past bull runs have followed a similar path, with BTC leading the way and rallying independent of the rest of the market, followed by a capital rotation event that sends altcoins flying as BTC drifts lower or consolidates.

There’s a strong possibility that this will happen again in the future, but it only remains a question of how long Bitcoin will rally and how high it will go before altcoins can gain some momentum.

One venture capitalist believes that the market is nearing the point at which a rotation from BTC and towards altcoins will occur.

He notes that sentiment surrounding Bitcoin can be characterized as no less than “general greed & fomo,” noting that this could be emblematic of a local high.

He also notes that altcoins have been undergoing sheer capitulation as their investors chase after the Bitcoin rally, which typically occurs just before these tokens boom.

Bitcoin Rally Puts Altcoin Holders on Edge

Bitcoin has been relentlessly climbing throughout the past few days and weeks, with its ascent even catching its most loyal supporters off-guard.

A combination of mounting retail demand and institutional demand is the likely suspect behind this rally, which has caused its price to run from multi-month lows of under $10,000 to highs of nearly $30,000 that were set last night.

This rally has not been too friendly to altcoins, as most have declined significantly on their BTC trading pairs over the past few months.

This has created a generally negative sentiment around altcoins and has also sparked some capitulation.

VC Claims Altcoins are About to Boom

Matt Kaye, crypto-focused venture capitalist at Blockhead Capital, explained in a recent tweet that he is slowly converting his Bitcoin to altcoins, noting that he expects an imminent flood of capital away from BTC and towards its smaller peers.

“I’ve starting selling BTC for alts over the past 7 days and will continue to. The extreme nature of this period is why. I’m betting on: – Extreme mrkt positioning – General greed & fomo – ALTs being under owned as holders capitulate for BTC – Cyclical nature of the market.”

If this transition from Bitcoin to altcoins does occur, it will confirm a trend seen during countless other crypto bulls markets, where altcoins strength is inversely correlated with BTC’s.

Featured image from Unsplash. Price data from TradingView.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/12/why-this-vc-expects-altcoins-to-boom-as-bitcoin-rally-enters-an-extreme/

Tether (USDT) To Face Do or Die Situation in 2021: Messari Report

Tether is the cryptocurrency industry’s biggest threat in 2021, says a report penned by Messari’s Founder Ryan Selkins.

The 134-page thesis ventured into the stablecoin’s emergence as a proxy for the US dollar that helps crypto traders getting in and out of their positions quickly on exchanges. It also focused on the controversy that tails Tether following the New York State Attorney’s class-action lawsuit against its founders and a sister cryptocurrency exchange BitFinex.

Boom Against Gloom

Lawyers Vel Freedman and Kyle Roche alleged in their October 2019 filing that Tether defrauded its investors, manipulated the cryptocurrency markets, and concealed illicit proceeds. They added that Tether printed billions of dollars’ worth of USDT stablecoin to artificially inflate the price of Bitcoin, Ethereum, and other cryptocurrencies.

But the market largely ignored the warnings. Tether’s market capitalization soared from $4 billion in October 2019 to $20.9 billion in December 2020. Mr. Selkins noted that the exchanges largely boosted Tether’s popularity in the absence of any other voluminous alternative. However, the situation could change in 2020.

Tether market cap. Source: USDT on TradingView.com

The research analyst discussed the worst-case scenario for Tether and BitFinex, citing the “dual lawsuits” against BitMEX filed by the Commodity Futures Trading Commission and Departmnent of Justince. He stated that an active investigation against the crypto derivative exchange caused its users to migrate towards alternative platforms.

Fearing the same could happen to Tether, Mr. Selkins presented a polar opposite Tether outlook for 2021 — a do or die situation as its market cap continues to grow amid an ongoing cryptocurrency market rally led by Bitcoin.

“Tether will either have an existential crisis or double its supply again in 2021,” he wrote. “There doesn’t seem to be a middle ground.”

SEC Investigation Rumor

Following the Securities and Exchange’s lawsuit against Ripple and its grossly negative impact on the firm’s native token, XRP, many agree that the Tether’s USDT could suffer a similar fate. But for that, the US Treasury needs to categorize stablecoins as securities.

And that is looking to come true. A Twitter user @RealWillyBot shared details about a DoJ order that ruled stablecoins as securities. He shared a screenshot that read:

“Depending on its design and other factors, the stablecoin may constitute a security, commodity, or a derivative subject to the US federal securities, commodity, or/and derivatives laws.”

If the proposal becomes a law, then USDT will become a security token. That could shock the cryptocurrency markets on the whole due to its overly addiction to the stablecoin that coughs out an average of $77 billion worth of transactional volume every day.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/12/tether-usdt-to-face-do-or-die-situation-in-2021-messari-report/

$30K BTC price imminent? This Bitcoin hodler metric hints at the next rally peak

Bitcoin (BTC) HODLer volume has marked previous tops and the start of bull cycles. As the dominant cryptocurrency heads towards $30,000, HODLer activity could be a useful tool to potentially gauge BTC’s next peak.

Since October, as Cointelegraph reported, the HODLing activity of Bitcoin has continuously increased. Fewer HODLers have been moving their holdings, which indicates an overall bullish market sentiment.

Why HODLer activity is important to assess Bitcoin market sentiment

The term “HODLer” refers to long-time holders of Bitcoin. It is possible to track the activity of HODLers by evaluating addresses that have not moved BTC for several years.

If HODLers move their assets when the price of Bitcoin is going up, it might indicate an intent to sell to take a profit on the rally.

Conversely, if HODLers move their assets when the Bitcoin price declines, it could mean they are doubling down on their investments.

Hence, based on the price trend of Bitcoin, a spike in HODLer activity could signal that a major price movement is imminent.

For now, HODLer volume suggests that a prolonged Bitcoin pullback is not likely to happen. The volume remains low in comparison to previous peaks, which shows that the confidence of long-time holders remains high.

However, HODLer volume could lag behind and begin to spike as the price of Bitcoin slumps in the near term. If so, the possibility of an extended correction could still emerge.

As such, it would be important to observe the HODLer volume in the near term, especially if Bitcoin struggles to rise above $30,000.

The technical momentum has been driving up the price of Bitcoin in recent months. But if that slows down, HODLers could move to sell, anticipating a correction to occur from the large number of investors sitting on unrealized gains.

BTC becoming scarcer is a variable

Until the HODLer volume spikes to previous highs, it would be premature to predict a sizable pullback in the short term.

Various macro factors, such as the declining dollar and the drop of Bitcoin liquidity, have made BTC more attractive as a store of value, particularly for institutions.

Cointelegraph previously reported that Bitcoin is becoming less liquid due to increasing HOLDer activity.

This means that there are fewer BTC that could be bought or sold, which makes BTC more scarce as it heads into 2021.

Rafael Schultze-Kraft, the CTO of Glassnode, emphasized that this is bullish for Bitcoin in the longer-term. He said:

“One of the most important #Bitcoin charts in 2020. Liquidity getting squashed, investors hoarding, accessible BTC becoming scarcer. 1M BTC have become illiquid this year, i.e. are held by entities that spend

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/12/30k-btc-price-imminent-this-bitcoin-hodler-metric-hints-at-the-next-rally-peak/

Fears of Bearish Correction Loom as Bitcoin OTC Deals Plunge

Bitcoin faces the prospects of undergoing a massive downside correction as on-chain data shows a plunge in its over-the-counter deals.

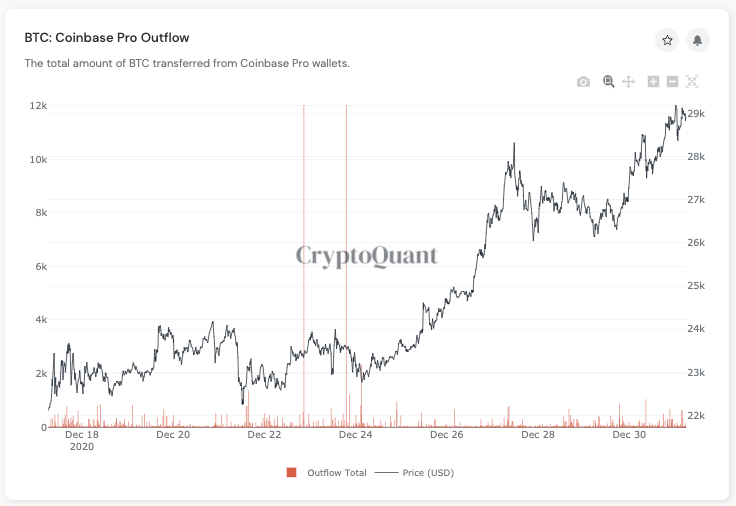

According to data fetched by CryptoQuant, the total amount of Bitcoin tokens flowing out of Coinbase Pro’s addresses to their newly-created custodial cold wallets has decreased ever since BTC/USD crossed above $23,000.

Coinbase Pro Bitcoin Outflow chart. Source: CryptoQuant

As CryptoQuant’s CEO Ki-Young Ju noted earlier, these wallets hold Bitcoin for major crypto-enabled firms like Genesis Trading (which buys Bitcoin for Grayscale Investments, one of the largest crypto accumulators) and Ruffer Investment (which bought around $750 million worth of BTC last year).

That allows the data analytics portal to equate large BTC transfers from Coinbase Pro to new wallets as OTC transactions.

Retail Involvement High

The statements appeared as Bitcoin logged another all-time high on Thursday, hitting $29,321 ahead of New Year’s eve. Its latest rally came on the backs of a devaluing US dollar and prospects of new institutional investments into the cryptocurrency space, especially after Skybridge Capital’s big reveal that it holds Bitcoin worth $182 million.

The news also coincided with a recovery in stablecoin inflows into all cryptocurrency exchanges from their December 13 low. A CryptoQuant metric earlier this week showed that the total number of stablecoin counts increased from 20,000 (BTC price: $19,270) to 30,590 ($27,000).

Bitcoin rally pauses after hitting $29,000. Source: BTCUSD on TradingView.com

That showed that the rally to $29,000 was majorly retail-driven, which further increased Bitcoin’s potential to correct lower in the coming sessions. Small and medium-capital traders tend to sell the cryptocurrency at its local top while investors with a long-term outlook use those dips to purchase it.

With OTC deals going down, it might be possible that institutions are waiting for the next Bitcoin correction to accumulate more of its units.

“We haven’t had significant Coinbase outflows since $23k, tokens transferred is decreasing, and the fund flow ratio for all exchanges is increasing,” explained Mr. Ju. “Still possible that institutional investors would join anytime soon, but we might face a correction if it continues like this.”

The 2021 Bitcoin Forecast

Many analysts agree that Bitcoin’s rally has become overheated enough to undergo a price correction. Nevertheless, that has not changed their perspective about a bullish 2021 ahead as long as the Federal Reserve stays on its indefinite monetary stimulus plans to aid the US economy through the coronavirus pandemic.

David Grider, the lead digital strategist at Fundstrat, said in a note that he expects the Bitcoin price to touch $40,000 within the next 12 months. He further noted that the cryptocurrency might face many bumps on its way upward, led by potential regulatory actions or mere profit-taking.

“We wouldn’t view these events as long-term negatives for Bitcoin, but if such events unfold, they may negatively impact broader market sentiment and prices,” Grider explained.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/12/fears-of-bearish-correction-loom-as-bitcoin-otc-deals-plunge/

‘Rat poison squared’ Bitcoin passes Warren Buffett’s Berkshire Hathaway by market cap

Bitcoin (BTC) has posted its highest transaction volume since early 2018 as data points to more and more investors entering the market.

Figures from on-chain analytics resource Digital Assets Data highlights December 2020 as already sparking Bitcoin’s second-largest transaction volumes.

BTC transaction volume eyes record

At a total of $252.37 billion the remaining 24 hours of December may yet take the tally further still as it rivals December 2017.

Other indicators, such as the size of unprocessed transactions in Bitcoin’s mempool and network transaction fees, also suggest heightened activity overall.

As Cointelegraph additionally reported, wallets containing both large and small balances also continue to increase to never-before-seen levels.

Google Trends, meanwhile, has captured the highest levels of search interest in “Bitcoin” worldwide since February 2018.

The reason, one which is attracting attention from mainstream sources as well as seasoned crypto traders, lies in the price bull run which continues unabated this week. At press time, Bitcoin was challenging $29,300 amid a stubborn refusal to consolidate lower.

On Dec. 30, the largest cryptocurrency surpassed the market cap of Berkshire Hathaway at $539 billion, the finance giant the CEO of which, Warren Buffett, famously likened Bitcoin to “rat poison squared.”

Ether continues to outperform

Despite its 290% year-to-date returns, however, Bitcoin still pales in comparison to the performance of the largest altcoin Ether (ETH). As Digital Assets Data confirms, ETH/USD has sealed gains of almost 500% since Jan. 1. Versus the March lows, performance is even stronger.

In a series of tweets on Wednesday, Bobby Ong, creator of price data site Coingecko, gave his predictions for the crypto market in 2021. Among the major tokens, Ether would see a return to higher transaction fees but pass its existing all-time high from 2018.

“ETH will break past its $1,500 ATH mainly driven by DeFi. Gas fees will skyrocket again and highlight scalability issues,” he wrote.

“Most of the year will be spent coordinating on a Layer 2 scalability solution. My bet will be on ZK Rollup gaining traction towards the end of the year.”

For Bitcoin, Ong forecast a price trajectory towards $100,000, alongside the launch of a long-awaited exchange-traded fund (ETF) and the first central bank adding Bitcoin to its balance sheet.

Credit: Source link

source https://cryptonews.wealthsharingsystems.com/2020/12/rat-poison-squared-bitcoin-passes-warren-buffetts-berkshire-hathaway-by-market-cap/

Bubble or a drop in the ocean? Putting Bitcoin’s $1 trillion milestone into perspective

On Feb. 19, Bitcoin’s (BTC) market capitalization surpassed $1 trillion for the first time. While this was an exciting moment for investors...

-

On Feb. 19, Bitcoin’s (BTC) market capitalization surpassed $1 trillion for the first time. While this was an exciting moment for investors...

-

Bitcoin, although a powerful and disruptive financial technology, at its core, is mere mathematics. Its code is what keeps the network oper...